Trade Shows In A Digital World

ISPO, the big daddy of the winter sports trade show season, has been rescheduled to late November. Is this just the beginning of a fundamental shift in the winter trade show market? SOURCE’s King of the Trade Shows, Clive Ripley contemplates the effects Covid has had on the trade show model.

Prior to the onset of covid, trade shows were already feeling the pinch. Brands had been progressively moving budget to where return on investment was more definable. The impact of covid and the subsequent cancellations of the 2021 winter trade show season has caused a complete reassessment of the necessity and value of trade shows. Brands had no choice but to find alternatives. In the new climate they were forced to adapt their sales systems so that they could handle presale and ordering online using a variety of digital tools. Online showrooms immediately became a necessity rather than a luxury. Traditionally, showing next year’s line to dealers and distributors had been the mainstay in the popularity of trade shows. However, this aspect of the trade show value chain is now significantly weaker. In particular the rise of digital B2B ordering systems has been a real game changer. This, combined with the overall move of business online, means that dealers are now much more comfortable making product decisions in the non-physical space.

In response, trade shows in Europe and North America experimented with a combination of hybrid digital and physical events but found they were unable to deliver the traffic that the physical trade shows previously provided. So, it was back to the drawing board for pure trade events to figure out how to make themselves more attractive to brands. No one doubts the value of face-to-face connection but the question is: what should be the backdrop and what else could be added to the trade show offering to increase the return on investment for exhibitors? Recently the CEO of a major exhibition company acknowledged that it’s a “work in progress” as they experiment with different ideas, whilst ISPO, the big daddy of the sports winter trade show season, has already made its move with a change of date to a November time slot. Thus making the event consistent with the continuous shift of many pre-book deadlines to earlier in the calendar. Before announcing its decision, ISPO polled its clientbase and an overwhelming number of brands supported the move. For many product categories, the new ISPO date means they have to receive samples earlier than they are used to but with the next show 12 months away, there is plenty of time to adapt schedules for those brands wanting to exhibit. For many brands, November time is also the month for European or global sales conferences. These could now take place around Munich, where the backdrop of the trade show means brands could meet two requirements in one go, saving on expenses and further raising the ROI on an ISPO booth investment. To make the show even more attractive, ISPO has also announced a restriction on stand sizes, meaning a more affordable outlay and therefore a more measurable return on investment.

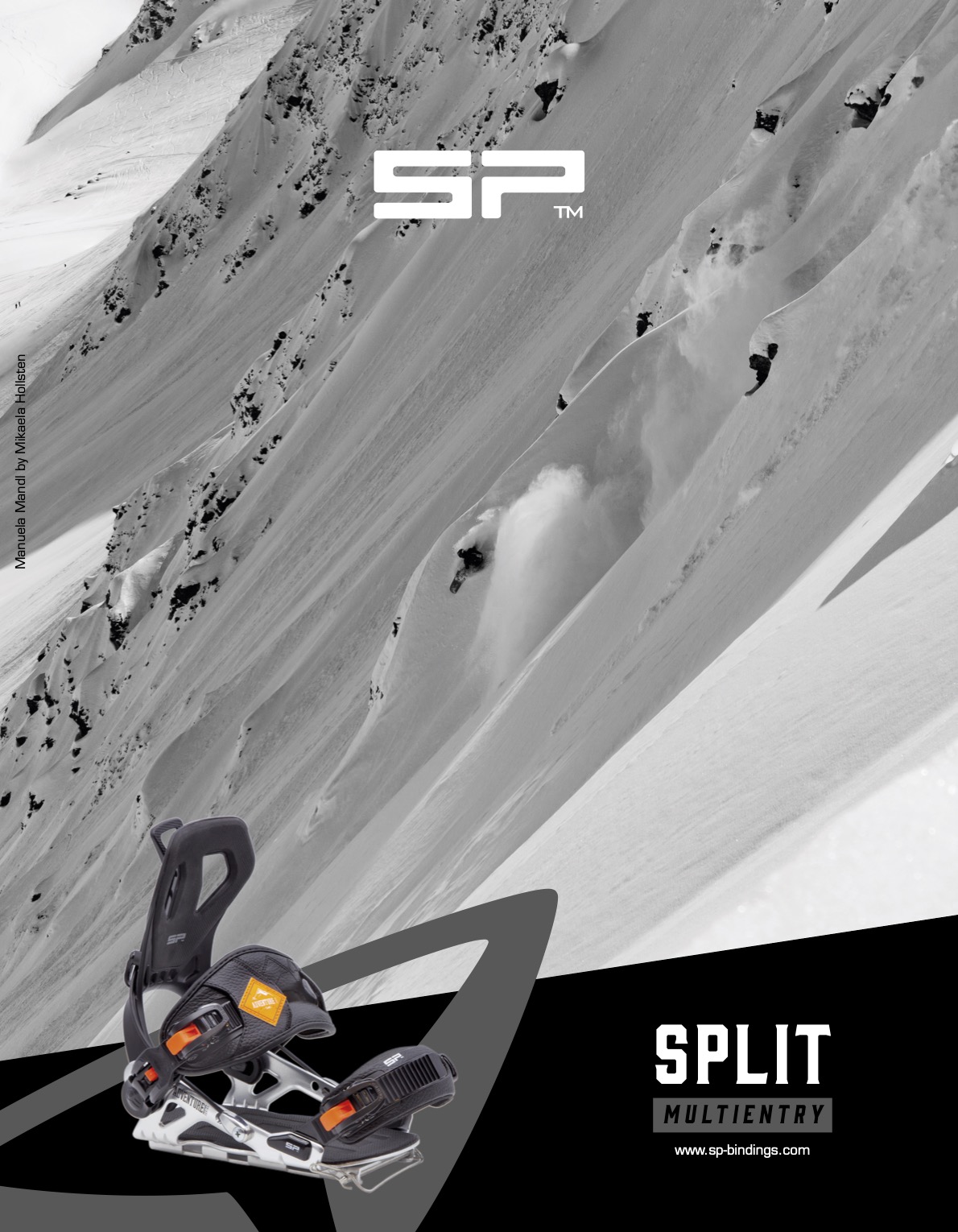

Meanwhile, smaller more specialised winter shows, on snow demos such as Shops 1st Try and Winter Pro have continued to find support from brands as product can actually be tested in the environment it was designed for, so no better way to discover for yourself what really works or does not. Costs of attending these shows are lower and the whole face-to-face experience is energised by the opportunity the backdrop offers to go “shred with your buddies”, doing what you love whilst talking shop. For the majority of the year, many brands and shops can feel isolated running their day-to-day business, so these smaller single sport shows are very important, building relationships and forming a real sense of community with everyone coming together for a few days.

This January, national winter shows will also return after a break of a year. These shows have the advantage of being close to their nation’s retail base, so travel regulations don’t really interfere, which is key to their survival as they have become very much meetings by appointment and order writing shows.

For retailers, the attraction of these different types of show vary; for the crossover retailers, who stock many product categories, a big multi-sports show enables them to see all the categories they stock in a single visit to a single location saving time and money. For core single sport retailers, visiting the small specialist show achieves the same purpose. Each brand and retailer has to work out their best option amongst a myriad of choices in this rapidly changing landscape.

One thing is certain, we are in the middle of a period of change. A process which had been slowly working its way through has been accelerated by covid.