EOG’s ‘State of Trade’ Reports 2019 Outdoor Market Up Compared To 2018

In its tenth year, the State of Trade market research project has published results from a comprehensive report on industry-wide sales. Broadly, it was reported that hardware and climbing have seen growth whilst apparel sales were down, linked to poor weather. The EOG has released a more detailed summary of the results- the survey was covers the 2019 market.

EOG reports outdoor industry growth in State of Trade 2019 research results

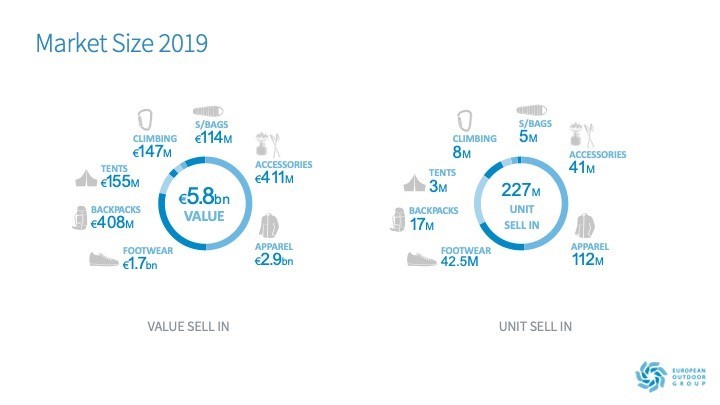

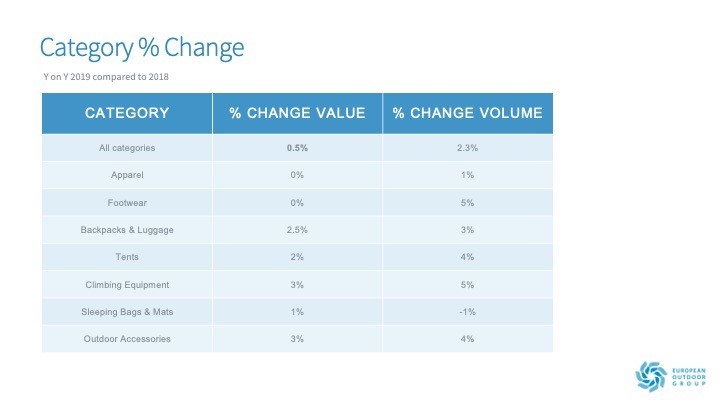

The European Outdoor Group (EOG) has released the latest results from its State of Trade research project, marking a decade of the industry leading report. Results for 2019 show that the wholesale market for the year was worth £5.82bn*, representing an increase of 0.5% in value and 2.3% in volume compared to the previous year. The report covers products sold by over 100 outdoor companies in the apparel, footwear and hardware markets, and also includes outdoor sell-in figures from multisport/lifestyle brands. The EOG has received, analysed and interpreted data in seven main categories and 48 separate sub-categories. After a flat year in 2018 (compared to 2017), the modest market growth shown in the results demonstrates the resilience of the outdoor sector in already turbulent times, before the COVID-19 pandemic.

Countries and Regions

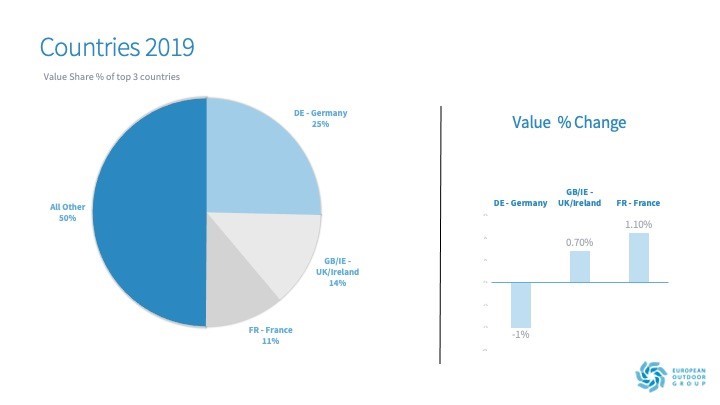

Once again, the largest three individual country markets were Germany, France and the UK, which together represent 50% of the sector at €2.92bn – these larger markets remained stable at around the -1 to + 1 % range in terms of value development.

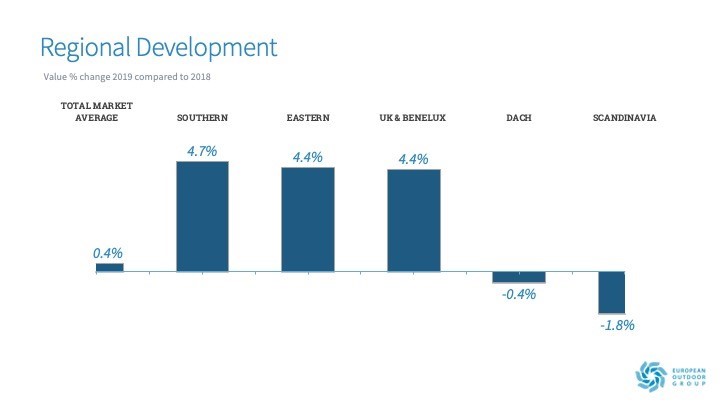

A very mild winter and lack of snow had an impact on Scandinavia, while in the UK, Brexit uncertainty contributed to weaker consumer demand. As a result, more positive development came from Southern Europe, Benelux and Eastern Europe.

A very mild winter and lack of snow had an impact on Scandinavia, while in the UK, Brexit uncertainty contributed to weaker consumer demand. As a result, more positive development came from Southern Europe, Benelux and Eastern Europe.

Category development

Overall, weather and market conditions had a negative impact on the apparel category, while hardware performed well and climbing continued to grow year on year (continuing momentum after 2018). After a tough previous year, footwear recovered well, with an increase in volume of 4.8%. In general, unit sales outperformed value in the majority of categories.

Since its launch in 2010 (with figures for 2009), State of Trade has grown into the most comprehensive and robust market research project for the European outdoor sector. The project is managed by the EOG’s head of market research Pauline Shepherd, and supported by the association’s members who submit sell-in data each spring.

Pauline Shepherd comments: “I want to pay tribute to businesses in our sector for the support and trust that they have given to the EOG over the last decade, which has allowed us to establish and then develop State of Trade so successfully. I am particularly grateful to brands for their input this year, and to our data partner infacta, where the team has worked extremely hard during a difficult time for the sector. Typically, we collect data from February and it’s testament to the commitment of our contributors that we have had such a high level of participation in the context of COVID-19. While the information took a little longer to come in and analyse than in the past, the quality of material was as high as ever and I’m delighted that we have been able to report these detailed positive results for 2019.”

Looking Ahead

Additional work carried out by the EOG during the last few months also indicates a sector with more market potential. The association’s COVID-19 market impact survey of members (hosted by Sport Marketing Surveys – www.sportsmarketingsurveys.com) found a sector made up of businesses that were working closely together to support each other.

Key finding from the survey include:

- Brands have supported the sector by extending payment terms and re-warehousing stock

- The outdoor industry is in a stable position, with most companies stating that they can survive more than 12 months in the current situation

- Companies are positive about the future, stating that the industry will come out stronger, and that they expect more consumers to take part in outdoor activities.

In addition, the EOG’s recent European outdoor participation study, in partnership with the It’s Great Out There Coalition (IGOT), established more opportunities to connect with consumers in different ways. Working with the global consumer trend agency the Foresight Factory, research was carried out during the second quarter of 2020, with consumers in seven European countries, providing insights about participation levels and intentions in all key outdoor segments.

The study determined that there is currently an increased appreciation for outdoor activities among the general public. Over half (55%) of the survey sample falls into an overall group who are open to being encouraged to do more outdoor activity. Specifically, four consumer segments were identified as offering potential for growth.

Pauline Shepherd comments: “This is clearly an important strategic issue, as we are looking at a market where growth has typically been in lower single digit numbers.”

In association with IGOT, the EOG will be spending the coming months sharing more information from the study with members, in order to highlight and develop market opportunities for the sector.

For more information about the EOG’s market research programme, call Pauline Shepherd on +44 (0) 7798 668999 or email [email protected]