Longboard Trend Report SS16

|

| Landyachtz |

As the longboard market continues to mature, brands are finding growth opportunities in premium and niche product lines, including “flat ground dancing.” With new labels and manufacturers still coming on board – Hello, Penny longboards! – our Boardsport SOURCE trend report breaks down the action. By Dirk Vogel.

Computer marketing genius Bill Gates famously said: “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten.” Applying these insights to the longboard business, it’s obvious that the market has changed dramatically compared to ten years ago, when longboards were still a sideshow act for most skate shops. Over the past two years, longboards have radically advanced into becoming a centre stage attraction as major growth drivers and revenue generators at many stores.

But looking at the next ten years, what’s ahead for longboards in the long run?

Most brand representatives in the segment remain optimistic, including Shane Maloney at Madrid Skateboards: “Longboarding, or more generally soft-wheel skateboarding, is bringing people into skate shops who didn’t previously identify with the ethos of street skateboarding, which had dominated the industry for decades. Skateboarding is not only about jumping down 20-stairs, spinning mega-ramp 1080s, or hitting 100km/h in a full tuck. Soft-wheel skateboarding has reminded people how fun simply cruising and carving can be. A lot more people can identify with that approach to skateboarding.”

The optimistic mood is buoyed by promising results, with most brands reporting increased sales on a year-on-year basis. As Steve Douglas at Dwindle brand Dusters California reports: “Our Long board business is up is up 50% in the past year and our cruisers are up 13% in EMEA and 26% up as a brand globally.” For 2015, Andy King at Mindless Longboards reports an increase of 55% YTD, but he also notices more specialization in the segment: “There is still a place for entry level boards to get younger riders in to the sport. But riders are certainly pushing the boundaries and needing ever more niche/technical intricacies to boards. We see longboarding having another good year in 2016 with new markets continuing to grow and established markets carrying on at hopefully a similar level to 2015.”

|

| Jucker Hawaii |

A WORD OF CAUTION!

Despite this widespread optimism, the ghost of market saturation is starting to rear its ugly head in the U.S. where trends traditionally tend to be one year ahead of Europe. Several brands responded like Mike Jucker, Co–Founder of Jucker Hawaii Longboards: “The European market is by far not as saturated as the US market and is still growing while the US Market reached its plateau in certain segments.” This sentiment is echoed by Marin McGinnis at Rayne Longboards, who reported “overall gains internationally with a softening in the USA.”

Keeping a close ear to the streets, Steve Douglas at Dusters confirmed: “The outlook for Dusters in EMEA is more growth. In the US, after speaking with key retailers, the drastic longboard and cruiser growth has definitely slowed. But after years upon years of growth it makes sense that things have cooled down.” Whether or not this signals a knee in the growth curve for Europe in the next year remains to be seen – but to say it again, trends tend to follow the U.S. with about one year of lag time.

NEW BLOOD: BRANDS AND CONSUMERS

Attracted by growth, new companies keep pushing into the category, including Brunotti, who are banking on, “easy access drop trough boards, which suits our mission ‘#getonboard’ where we try to get everybody on a board,” said Frank Uyt den Bogaard – Creative Marketing Director at Brunotti. Shiner distribution’s new brand, D Street, has already been doing great, said Karl Martinez: “We have had a phenomenal year with sales up 92% YOY, we are still a young company but really climbing up the ladder now in Europe.” Other newcomers include OBFIVE, described by Brand Director Kris O’Brien, “as more of a surf/skate/lifestyle brand. We are focusing on delivering our brand message to a broader market in 2015.”

Based in Frankfurt, “Nice Skateboard is enjoying a fast growth and development. With a jumpstart in 2014, the company is now to embark on its fourth production run of the first 20 models of longboards and is about to release 28 new models up until the beginning of 2016. In the first run we focused on all kinds of dropthrough longboards,” said general manager Gerd Weisner.

Even Penny Australia is moving along, introducing their first plastic longboard at an RRP of £149.99 in a variety of primary colours with matching trucks and wheels. Penny Skateboards founder Ben Mackay says: “As a skater, I want to ride a unique longboard; one that handles completely different from all others on the market; and we certainly couldn’t ignore the growing Penny community, who have been asking for a longboard for quite some time.”

|

| Sector 9 |

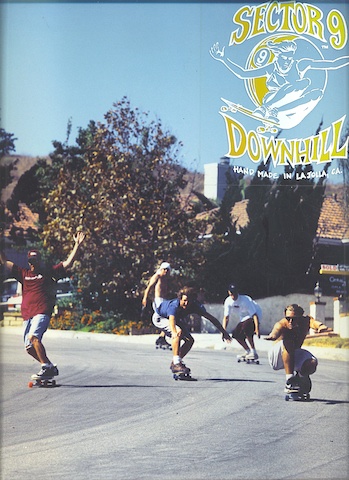

Along with their entry into longboarding, Penny shared some consumer insights from a Penny global fan survey of 7,966 people: “44.8% of those who own a second skateboard ride a longboard for cruising, while 22.5% ride a longboard for downhill.” At Dwindle, Steve Douglas also had interesting news about demographics: “Our main target is still around 18-24 year-old men but we have seen a big increase with younger kids at 13-17 and a much bigger following and engagement of girls. For 2016 we will definitely invest in this expansion so the outlook is to see that increasing even more!”

THE EUROPEAN MARKET

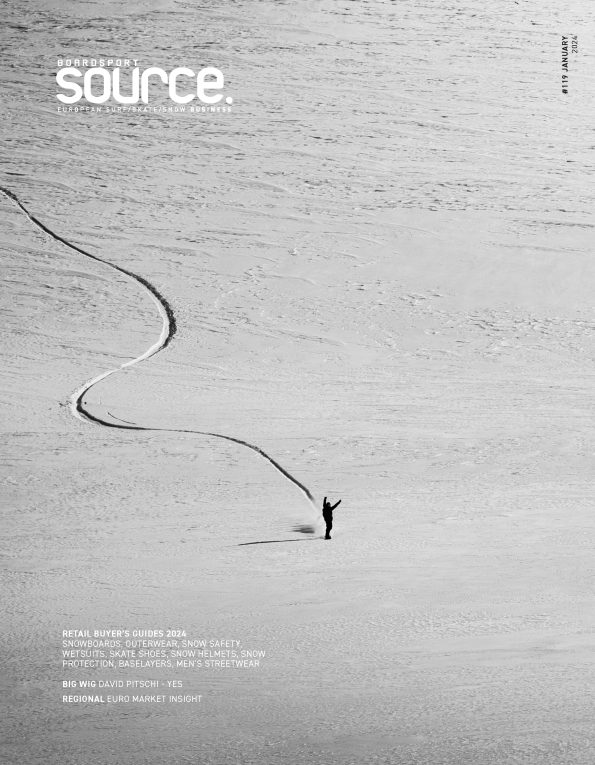

Generally speaking, it’s a more mixed bag says Marin at Rayne Longboards: “The European market is much more diverse than the North American market. We see many more regional trends in Europe than we do in N. America.” At the same time, Andreas “Maui” Maurmeir at Sector 9 Europe sees the scene becoming more diverse in terms of riding styles and products: “Europe gets more and more open for traditional US dominated skate terrains such as mini freeride boards or longer and more sophisticated park boards. That took a long time in Europe!”

Breaking down preferences in the European market by territory, Don Tashman at Loaded said: “Flatland dancing and freestyle are somewhat more prevalent in Northern Europe and have a much stronger community and events. European cities generally lend themselves better to skateboards as transportation than US cities do, and we’ve found a strong growth in our commuting and carving line because of this.”

On the positive side, Matt Wong, President of Globe’s product division noted: “In Europe we’ve been doing especially well with boards with higher end woods and design features – which also carry higher price points. For example our Cabin Series, which features styles like The Cutler has done really well. These boards combine nicely finished walnut veneers with unique mother of pearl inlays for a really high-end finish.”

|

| Madrid |

PRICE POINTS FOR 2016

Speaking of ‘high-end finish’ and premium constructions, these are also the main drivers behind an elevated price point ceiling for longboard completes, says Mike Jucker: “Paying top money for a board is OK if the quality goes along with it. We have found that the average consumer is willing to spend +/- €200 for a good quality board. After that the market becomes smaller.”

As Chris Brunstetter, Marketing Director at the Goldcoast Skateboard Co. breaks down 2016 pricing: “Longboards seem to be at a €190 sweet spot, decks €100, trucks €50 per set, and wheels €35-€40.” In the long run, smart pricing policies are the only way forward, said Maui at Sector 9: “Curate your customer and you name the price. We are no discounter. That kills it all.”

THE 7 BIGGEST LONGBOARD MARKET TRENDS

Looking at top-secret product previews from leading brands for next season, the following seven major trends emerge in the longboard market:

1. Specialization and sub-sections. Europe has come a long way from one-size-fits-all entry-level boards, so retailers need to know their audience and adjust their line-ups accordingly. “The longboard market is more mature in Europe than it is in Australia. We find that Europe have a lot more emphasis on downhill riding and dropthrough styles, and therefore offer a lot of different shapes and sizes to cater for this market,” said Kris O’Brien, Brand Director at OBFIVE. Two hot new trends include ‘dancing’ on boards, as well as commuter boards with technology under the hood.

2. My second board is a carver. Consumer behaviour is trending towards building quivers with different boards for different situations. Nate at Landyachtz confirms: “Customers are beginning to collect longboards and having specific shapes for specific riding styles. This is great news for 2016 as an entire market is opening up from the average person who is cruising for fun, to the commuter, to the downhill freerider.” Mindless Longboards are supporting this trend: “Our price points for twin tip, drop through and freeride boards are more affordable than before, allowing consumers to upgrade and change boards more frequently and add more boards to their personal range.”

|

| Dusters |

3. Shapes: Drop-Thru is king! While diversity is growing in terms of riding styles (see 1.), we seem to have a clear winner in the shapes game, as Chris at GoldCoast reported: “Europe is selling a ton more dropthroughs than the US for us! General outlook is that our business is going to shift more towards dropthrough models, and inching up the price point.” This trending shape is taking away from previous category leaders, said Nathan Pauli, VP Sales at Origin Distribution (DB Longboards): “Twin tip dropthrough shapes have continued to grow in popularity and seem to attract an increasing number of first time buyers who would have previously purchased a pintail board.”

4. Elaborate details in the premium segment. The trend towards elaborate wood laminates continues, supported by upscale finishes and prints. Ross Bradley, International Sales Manager at Osprey: “For 2016 we have added an ever wider mix of styles and colour palettes including tie-die patterns and photographic designs which appeal to a broadening longboard demographic such as the growing female longboard market. We have a sweet new laser-etched deck in our top end range, which is completely different to anything out there.” Meanwhile, Jucker Hawaii is, “working with more sustainable materials. We do not like plastic even if in some areas the trend seems to go that way.” At newcomers Brunotti, the “main material is an 8-ply wood construction and our new bamboo glass fibre sandwich construction.”

5. Technology is the future. Speaking of the race for new R&D, Don at Loaded Longboards made a funny observation: “Thermoplastic construction like Bustin uses makes sense and could end up being the future of composite construction. The hollowtech construction from Landyachtz is sick. The use of recycled plastic fishnets by Bureo is inspiring. And the ‘fat-bottom’ style constructions of Rayne and Icone are ingenious. At Loaded we’ve converted all our boards to a new construction made from cloned mastodon tusks in a forged nano technology spider web matrix.”

Marin at Rayne is stoked because, “our customer base continues to lose their mind when we release Dee-lite versions of our boards because they are just as strong as the standard version, but 15% lighter.”

|

| Loaded |

6. Accessories with an edge. Wheel colours are bringing heavy 1980s neon flavours into the mix, while the entire set-up tends to be colour-coordinated. Maui at Sector 9 confirms: “We can say that colour tuning becomes more and more demanded. The wheels need the right colour with the deck and so on. Especially in the classic ranges like carving and cruising.” Meanwhile, Sector 9 has been “killing it” with downhill gloves and slide gloves, said Griffin Halpern, International Sales Manager Griffin Halpern. And while retailers are stocking up on gloves, Nathan at Origin also points out the latest tech from Atlas: “The Atlas Touch glove will bring cell phone friendly touch finger technology to the slide glove category for the first time. No need to remove your gloves to take pictures or send text messages!”

7. Don’t try to do it all. For retailers, the main mantra for 2016 is: Know yourself (and your customers) and stay the course, instead of trying to do it all. Shane Maloney, from Madrid confirms: “On the retail side, established retailers will always have the advantage, but those who do not pay attention to the market trends and adjust their approach will be in danger of losing sales to the newcomers who are paying attention.”

With the right fit between brands and retailers, the next ten years in longboarding are looking rather bright. Maui at Sector 9 concludes: “People no longer stick to just one board. If you stoke them with the first they will come back and get a second or third one. That is why it is so fun to work with excellent products and good marketing – you relate to the customers and get them to become regulars at your store.”

HIGHLIGHTS

+25% growth YTD in sales

Premium RRP over €200

Saturation in US – next in Europe?

Girls getting into longboarding

Drop-thru shapes dominant

Colour-coordination

Major movement in gloves segment!