Foiling S/S 2026

Precision engineering and clever designs are setting the pace of foil sports development, promising a future full of lift and no drag. By Rocio Enriquez.

The foil market has been showing signs of maturity for the past year, with growth spread across multiple disciplines. Windsurfers and wing foilers are sharing the waters with increasing numbers of downwind SUP, prone, and pump foiling practitioners. Brands are echoing this diversification with a wider product mix. Shops are keen on stocking a full foil range. The demand is leaning towards high-end, technically advanced products. Brands aim for quality and performance as key differentiators. While industry sales are down from past peaks, especially the post-pandemic one, there is overall stability and growth in the foil category. New disciplines have contributed to this. There is ongoing enthusiasm in the foiling community, which brands are factoring in their production forecasts. Stock levels have stabilised. There is still some leftover inventory that keeps prices down. This could have contributed to a rethinking of the production planning. There is an observable trend of phased product launches and on-demand manufacturing aimed at avoiding excess stock and maintaining innovation cycles.

In-house manufacturing helps balance availability for retailers with avoiding overproduction. Stock management is becoming a key competitive advantage. Wing foiling continues to dominate the demand. Its accessibility, versatility and the ability to ride in varied conditions make it very attractive to users of all riding levels. It is also becoming competitive with racing, freestyling, and big air modalities increasing in popularity. Media coverage of events and athletes is helping. There is a strong momentum in downwind foiling, especially amongst advanced riders seeking the thrill of a long glide. Mid length boards and crossover equipment that can be used for both downwind and wing foiling are enabling its growth. Pump foiling is attracting younger users for the affordability and low entry barriers – all it needs is a dock or pier and the water.

Foils.

Entry-level set-ups remain strong sellers. Not only they offer a low barrier to entry, but they help riders progress quickly. Liquid Force’s Launch and Horizon’s Alloy kits are two examples. SIC Maui pushes their Flite Complete kits for beginners and lighter riders. Racing models help the competitive segment, catering to advanced riders that seek stiffness, control, and speed.

In this category Starboard’s SLX and MF, Levitaz’s R6 Race Series, and SIC Maui’s Slash front wing 600 have topped sales. Levitaz builds up on the success of the Race series to launch the brand new Freeride series platform focused on performance. Versatility has been a good selling point. Set-ups that adapt to different riding styles and conditions, and even multiple disciplines, have been popular. Here we find NSP’s Riblet, or Slingshot’s Glide and Flow. “The Riblet’s carbon construction and hydrodynamic design make it a favourite among both performance-focused and progressing foilers”, says Jarra Bitton from NSP.

The modularity of customisable set-ups helps tool-free quick adjustments and easy travel. SIC Maui’s Flip Fuselage offers two options in one. The user can install the Pump Arrow forward for more lift, stability and pumping power. Flip it around with the Steering Wheel forward, and you get lighter turns and a more responsive ride. Slingshot’s One-Lock platform also performed very well in sales. This is a screw-free system that enables riders to build their ideal set up without the hassle of bolts or tools, simplifying progression. Lastly, the cost-conscious consumer has leant towards a compromise between fair pricing and high performance. Indiana’s HP foil collection sold the best for its fair price level for a high-end product. These bestsellers evidence the main trends in design and technology. There is a focus on stability, stiffness, and control.

“We use the stiffest and lightest materials where we can, while maintaining durability”, says Philipa Murphy from Flite Lab. Liquid Force focuses efforts on their Fuse Lock system. Its new shelf design between the wing and the mast reduces wing wobble allowing the foil to perform fully as it was designed to. Adjustable stabilisers and unique fuselage designs enhance fine-tuning without shims. “We are expanding our Monobloc foils offer by adding new front wings like the Barracuda L+, new stabiliser tails, and faster masts like the Hyperdrive UHM in 76, 86, and 96”, says Niki Dietrich from Indiana. High-modulus carbon is becoming the norm, especially in masts and front wings. It improves the stiffness and responsiveness without added weight.

Gaastra is combining their existing ultra-high modulus carbon mast with a newly developed front wing, fuselage, and rear wing set-up. The front wing is integrated in the front segment of the fuselage for a streamlined tip with minimum drag and turbulences. UHM carbon is not the only premium material on offer. There is growing use of titanium hardware, corrosion resistant finishes, and advanced lamination techniques that secure longevity. “We feel a strong demand for ever higher spec carbon parts and the use of titanium and steel parts to chase the ultimate”, says Tiesda You from Starboard.

Shapes and features are quite performance driven. High aspect front wings enable glide and speed. “The trend is increased wingspans, the goal is to be able to glide all the time, even in very light wind conditions”, says Bruno Sroka from Sroka. Gaastra’s new Move front wing has a higher aspect ratio for all-round performance. Optimised foil wings reduce drag. Modular systems allow precision fit, faster set up, and swapping wings, stabilisers, and fuselages to match conditions. Tool-free connection systems are highly valued, for their ease and accessibility.

Boards.

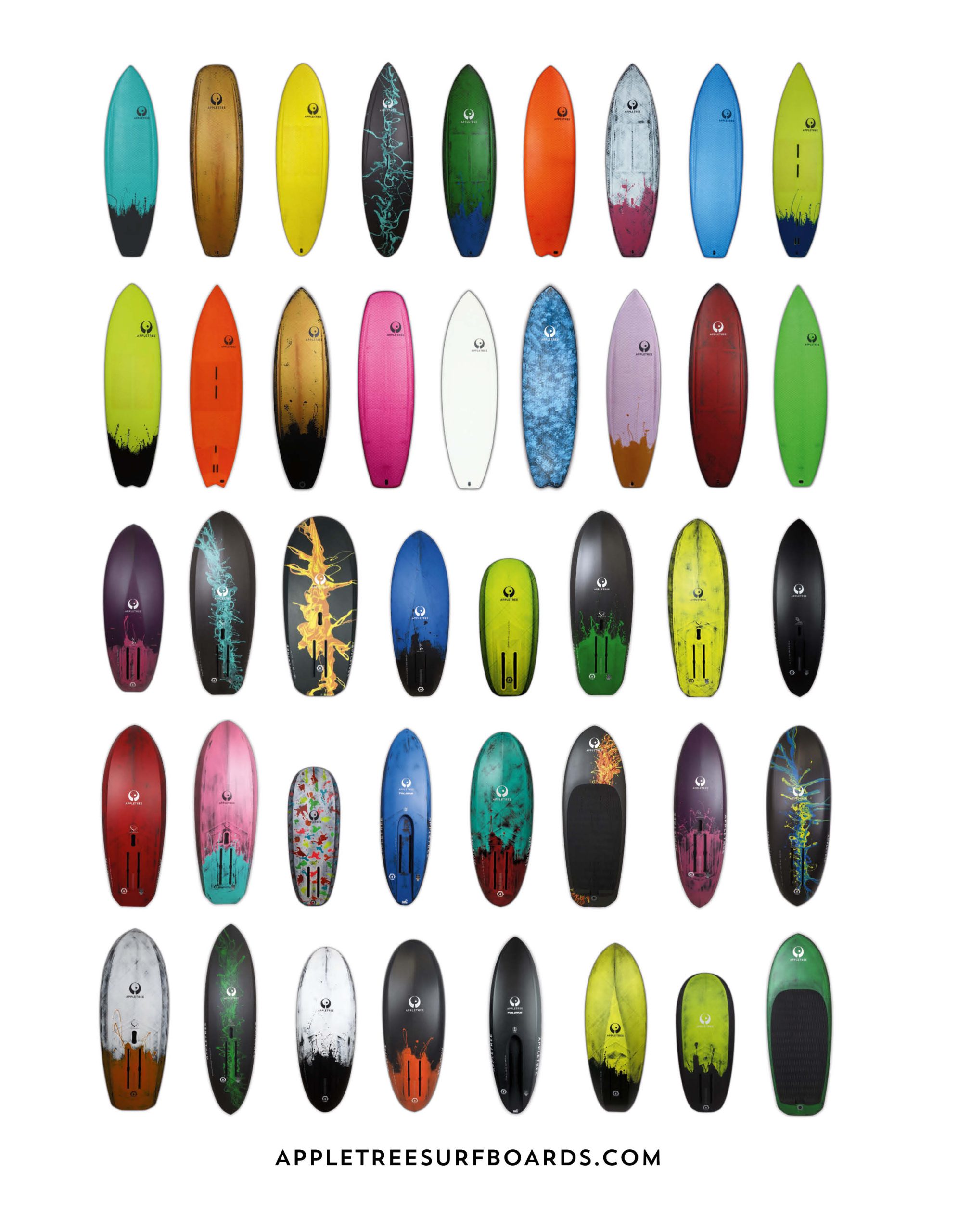

Mid length and all-round boards dominate sales, as they allow wave riding, parawing, prone foiling and light-wind wing foiling equally. They are valued for their versatility, a key selling point. Many riders look for one board that will cover multiple disciplines. Appletree reports their best results with their all-rounder Apple Slice V3. Slingshot’s versatile Flow Craft v1 has been a strong performer too. Niki from Indiana says: “We see the biggest growth in our compact mid-length Super Fly CML boards”. He also announces a new “All-round / Flat water” range for 2026. Norden’s best sales have come from mid length boards with all-round characteristics, followed by entry level boards. This is a category that continues to sell well, reflecting the steady growth that new participants entering the sport provide. Sales of compact, high-performance boards for advanced riders are increasing. Levitaz has done well with the Boom RS 58 for wing racing and the Boom 75 for freeride winging. Slingshot’s Hope Craft V2 is also popular amongst those looking for stiffness, responsiveness, and optimised control. Pump foiling is growing. Indiana is investing in this segment, based on the strong and growing sales they are experiencing in pump foil boards. Most brands’ line-ups cater to both new entrants and expert riders. This results in two main board subcategories: the progression-friendly and the elite performance. The first ones, short or mid length and wider, provide easy lift and stability. In this category we find Liquid Force’s Launch for beginners, and the Horizon which bridges the entry-level to intermediate.

NSP’s Spitfire 2.0 is a mid-length SUP and downwind board. Slingshot’s Glide Craft V1 is an accessible mid length with extra stability, ideal for learning transitions. SIC Maui offers the Ka’a, a narrower mid length board. Its pulled-in tail adds control for smooth carving, and longer foil tracks ensure the same nimble feel of a shorter board. The second sub-category comprises longer and narrower boards. They are lightweight, compact, stiff, and responsive designs. Here we find Liquid Force’s X high-end surf style, NSP’s Bluefin EVO elite downwind board, Levitaz’s Raze series, Sroka’s LW boards, and Slingshot’s Flow Craft V2, a performance mid length. “The new Bluefin EVO is the next evolution in our downwind foil range, engineered for elite riders chasing ocean glides and open-water speed”, says Jarra. There are some design refinements for control and feel. Narrow widths enable a harder and more aggressive carving without rail catch. Reduced thickness allows direct foil feedback. Tail shape optimisation offers better turning and lift management. Chine rails and pin tails result in smoother touchdowns and reduced drag. In construction, carbon and hybrid carbon layups are now the standard. They provide the stiffness, strength, and low weight that consumers are after. We see hybrid sandwich builds of carbon and wood or PVC that balance performance, durability, cost, and sustainability.

Sustainability.

The growing awareness that carbon production is not eco-friendly has sparked interest in alternative materials for board construction. However, there is only so much that can currently be done regarding materials for such performance-oriented products. Sustainable efforts are concentrated mainly in production processes, logistics, product longevity, and environmental advocacy. Appletree and Liquid Force use solar-powered manufacturing. Appletree, NSP, Norden, and Slingshot optimise production to minimise excess materials. Designing boards and foil set-ups to last longer reduces the need of replacements. “We have an industry that pollutes, so the only thing we can do is produce solid, high-performance products that are built to last”, says Bruno Sroka. NSP uses closed-cell foam cores and advanced shaping methods to extend product life. Modular systems like Slingshot’s One-LockTM allow upgrades without full replacements. Levitaz and Norden also prioritise durability in their designs. Packing and shipping offer plenty of opportunities to offset carbon emissions. “We optimise the processes with pre-orders and promote boat transport”, says Benjamin Tillier from protection gear brand WIP. Appletree and Levitaz manufacture in Europe, not only cutting emissions but also supporting local economies. Along with Slingshot, they also use recyclable packaging. Support for environmental organisations like Surfrider Foundation or Sea Shepherd is commonplace. Appletree also commits to safe and fair working conditions.

Retailer Support.

Education and access to try the product are possibly the most efficient support systems in a product category that is highly technical and new at the same time. Education is delivered in many forms, like product videos, usage guides, and online staff training that do not only explain product choices but also the terminology used. These tools can also make foiling more approachable. First-hand experience is enabled through demo units, test centres, and flagship stores, where customers can try the gear before buying. Traditional marketing support is activated too. Brands have team rider programmes that generate content and visibility. There are also coordinated product launches that efficiently time seeding to athletes and dissemination of content. This is accompanied by visual assets ready for retailers to deploy at their convenience. Collaboration with retailers at all stages of the product life makes a difference. WIP factors retailers’ input in their development and strategy.

Levitaz has created the Performance Centres concept that provides exclusive product access, priority support, and co-marketing. Finally, there are some logistics and stock solutions to support retailers. Norden offers pre-order incentives and margin benefits. Indiana reduces the stock risk of their retailers by offering drop shipping. Starboard uses local warehousing for a faster delivery. “We also have an online ticket system to deal with issues that may arise”, says Tiesda.

Foiling has settled into a confident rhythm – stable, diverse, and still buzzing with innovation. Wing foiling leads the charge, but new disciplines like downwind, prone, and pump foiling are luring more riders into the water. Lighter and stiffer gear, and smart modular systems keep the market fresh. The focus ahead will be on refining technology, strengthening sustainability where possible, and making foiling sports even more accessible. The right kind of support will help retailers keep a healthy stock to supply the demands of newcoming enthusiasts. The synergy between brands and retailers, combined with the widening appeal that new disciplines offer, is a winning combination for the future of this promising sport.