Snowboard Bindings 2024/25 Retail Buyer’s Guide

Despite last year’s poor snow conditions in Europe, the snowboard industry has apparently recovered from most of the challenges it has faced since Covid. Brands are almost unanimous in claiming a healthy start for the current winter. With a new wave of snowboarders hitting the slopes, last winter helped empty stock, support retailers, and keep building what snowboarding is – a form of expression that can occur in natural and urban landscapes alike. There’s no reason to stop this momentum and 24/25 is loaded with products that aim to satisfy this growing demand.

Snowboard bindings are no stranger to this trending growth and our journey on snow can only get better! Ladies and gents, welcome to next winter’s Snowboard Bindings 24/25 Retail Buyer’s Guide, brought to you by Matthieu Perez.

Trond-Eirik Husvæg at Vimana confirms the strong hype currently fuelling snowboarding, but also states that it has definitely changed in the past couple of years: “Snowboarding is a lifestyle for a lot of people, but a lot of riders see it more as an activity than a lifestyle”. According to Barrett Christy at Bent Metal Binding Works, “A lot of people got in (or got back in) during the pandemic and are now looking to upgrade their equipment from rental to personal ownership, or from beginner to more advanced product”.

Bataleon observes some of the healthiest stock levels in quite some time at both its warehouse and at its retailers. Sales manager Rubby Kiebert opens the gig with a new breath, noting, “There’s a lack of older products in the market, indicating a renewed emphasis on selling the latest gear”.

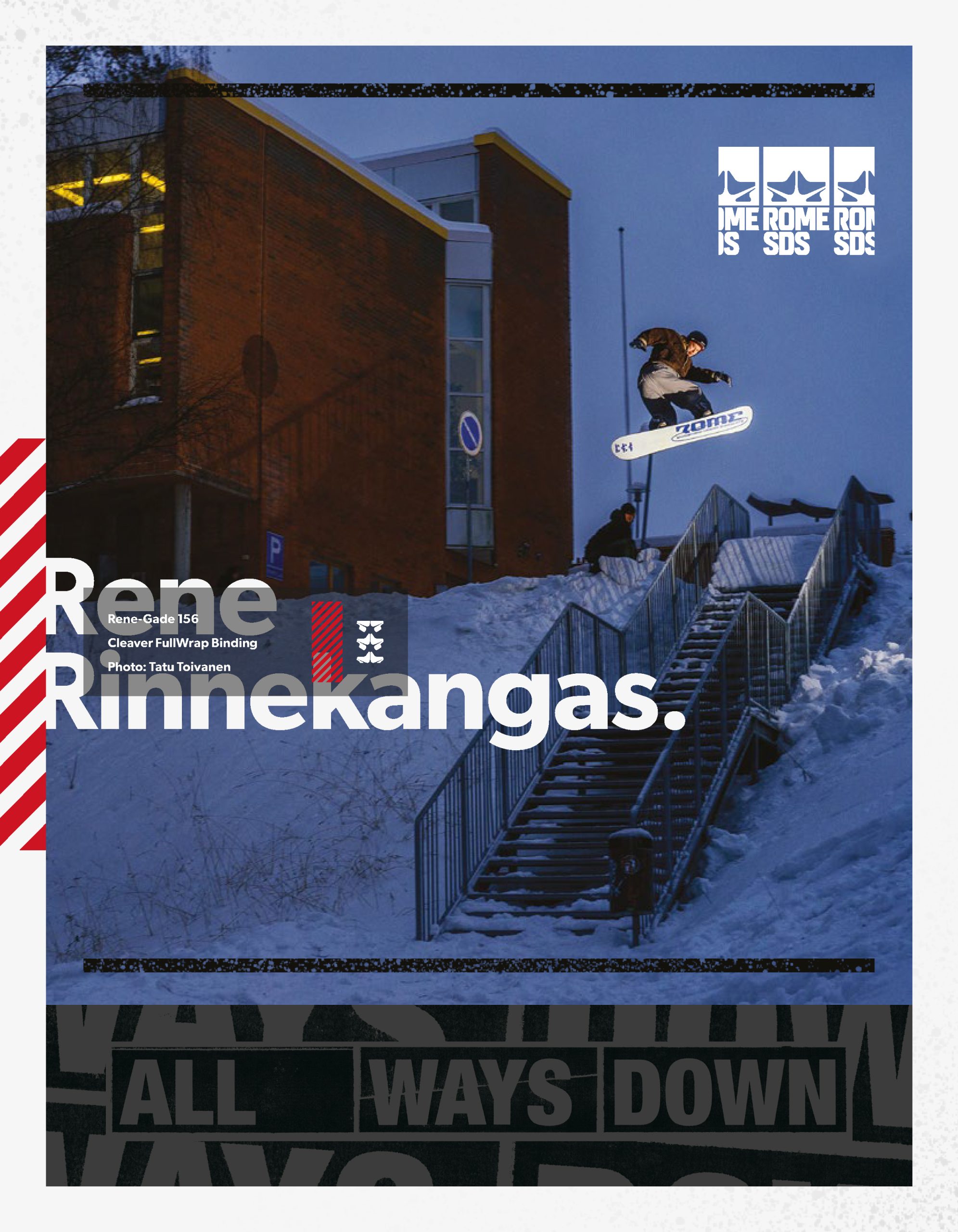

Some are perhaps more cautiously optimistic. Matt Stillman at Rome explains, “It feels like everyone is eagerly watching the European weather and markets to see how they might rebound after such a tough year, but stoke is high and vibes are positive”.

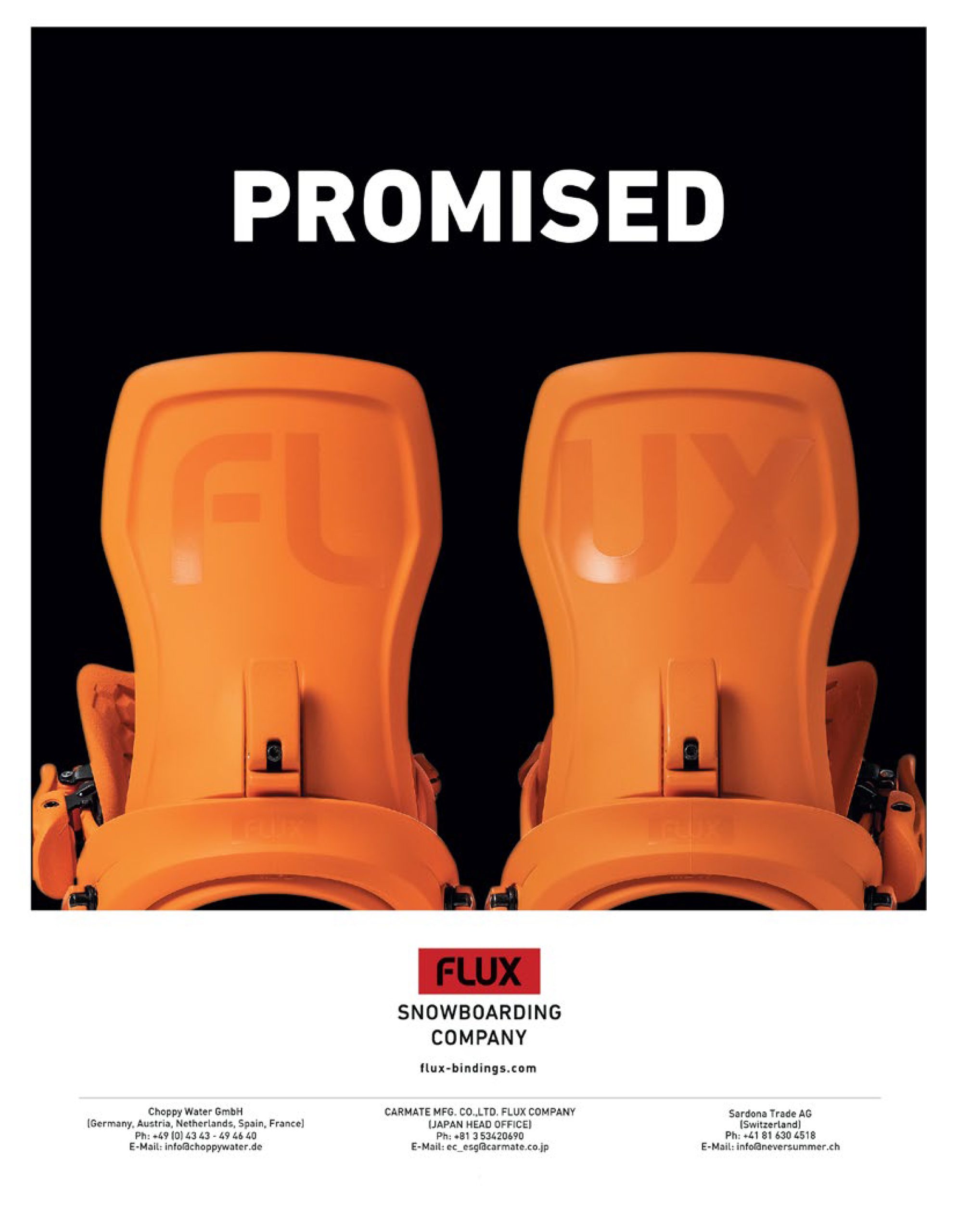

Every brand is navigating this landscape in its own right. Flux is exploring new opportunities on the heels of a rebranding. The company changed its logo and is trying to focus more on promotion and marketing. And for Kyle Hansenkhan, Karakoram’s marketing manager, “The last few years were a wild ride – high highs, then whiplash as the market returns to more typical levels. For us, the focus is on our core rider customers”.

HOT CAKES!

In the midst of new products and messaging for next winter, some brands are rolling out big news for their network and customers. David Pitchi at Yes Snowboards just announced that the brand teamed up with Now Bindings. He explains, “We’ve merged these brands to provide a more comprehensive and prominent range of products. This move gives us a stronger visibility, increased resources for development, and an overall better product offering”.

At Nidecker, Tom Wilson-North hammers, “We’re excited to announce that Nidecker has brought Flow Design bindings under our own brand umbrella, so we now offer the widest range and selection of snowboard bindings out there. Alongside the traditional manual Two-Strap line, we now offer a range of semi-auto Flow Design models, plus the fully automatic Supermatic models with Drop IN™ technology! We don’t consider any of them to be better than the other, it just boils down to personal preference in terms of feel and function. In the end we have excellent options no matter what the customer is looking for, and by stoking them out we hope to keep them snowboarding for life”. It’s definitely a noble mission.

STOCK IT OR NOT STOCK IT!

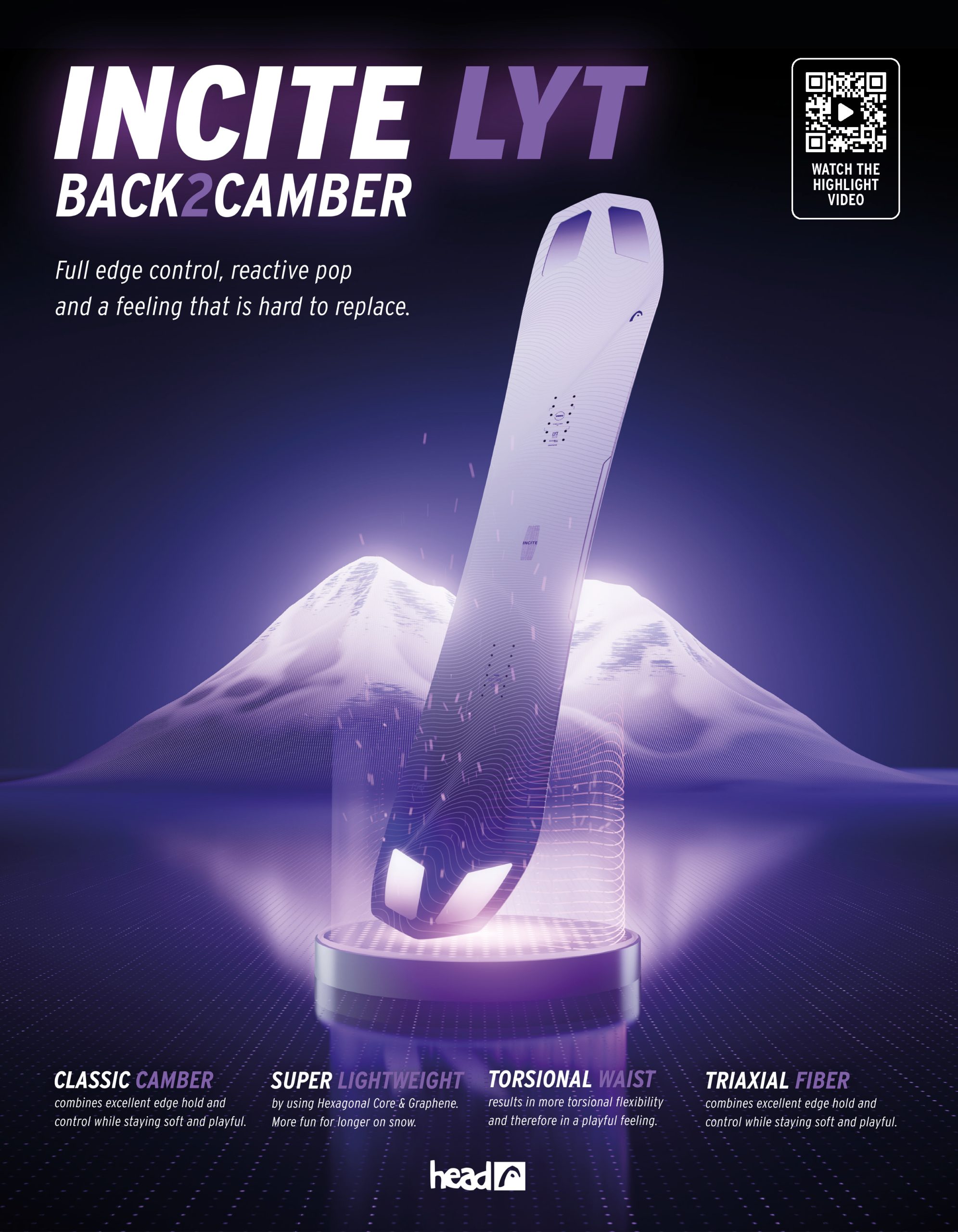

Different approaches to inventory are popping up. Overall, there is not much stock at SP Bindings. The brand notes that even its sales in Europe were better than expected. Head reports the same. According to Katharina Acham, Head operative marketing manager, “The warehouses were empty after winter season 22/23 and we were facing high order volumes for season 23/24. We are doing our best now to get all goods into the stores in time. We are looking ahead to season 24/25 with confidence as the orders are high again.”

Nidecker is optimistic about the 24/25 season. “We will continue to operate our never-out-of-stock strategy and are convinced that popularity on items like Supermatic will continue to generate interest in the brand and other products we have in the range”, says Tom Wilson-North.

Others are taking a more careful route. Barrett Christy at Bent Metal Binding Works states, “We believe in the prebook model which allows us to plan accordingly. As for at-once, we take a conservative approach with still being able to fulfil the demand but also not to over-produce. We live by ‘sell out, don’t close out’”.

Bataleon is incredibly grateful for the steadfast support of its dedicated audience, as evidenced by the swift depletion of last year’s inventory. “Looking ahead, we are confident in our prospects for the upcoming winters. Should the need arise, we have the flexibility to adjust stock levels in our warehouses on both sides of the ocean, ensuring optimal support for local demands”, indicates Rubby Kiebert, sales director.

Snow Category Manager Arnaud Repa dissects Rossignol’s strategy, emphasizing, “Foster customer commitment. Monitor sell-out, demand plan, raw material availability and development timeline to reduce storage costs and optimize manufacturing.” Sounds like a plan.

OUT WITH THE OLD, IN WITH THE NEW.

Now come the freshies and everyone is shaking the tree of innovation and progression. Amplid is introducing two new binding models, the Proton and the Proton C.I. The brand is using a new nylon with carbon fibers, supplied by BASF. This allows Amplid to offer two very different bindings out of one mold set. One stone, two birds.

At Clew, innovation is a constant pursuit, and they have indicated that developing new products and experimenting with new materials is a continuous process.

Same at Vimana, which is working hard finetuning its line. “We believe less is more, and want to make the line as easy as possible to understand and work with. Both from a retailer and consumer perspective”, says Trond-Eirik Husvæg.

For its 23/24 line, Arbor introduced the first-of-its-kind BioStrap to the Cypress and Sequoia models which are composed of 64% Castor Bean Oil. Beyond using a renewable resource, the BioStrap maintains mechanical properties at cold temps, which maintain the flexibility of the straps— increasing comfort and durability. The brand is excited to announce that moving into 24/25 it will also introduce the BioStrap to the Hemlock binding.

The big news in the Jones binding collection for 24/25 is the debut of the Mercury Pro binding. Marketing Director Seth Lightcap explains, “The Mercury Pro is a high tech freeride binding that features a unique three-part highback. It’s designed for expert freeriders who need a super responsive binding with a progressive flex. The three-part highback is super stiff in the heel for max response, slightly less stiff along the spine of the highback for manoeuvrability, and softer on the outer edges for max comfort”.

Bent Metal Binding Works features flex control driveplates with unique flex patterns for dynamic binding response. Next year, it will bring a new canted footbed with a heel shock pad to several existing models, including the Axtion, Logic, and Transfer, as well as the women’s Forte. The new Anvil model will also have a canted EVA footbed for increased precision and control. “These driveplates are unique to the binding market and set us apart from every other brand. They are a key component to our binding designs and they are made with environmentally friendly processes and construction”, adds Barrett Christy.

Drake is developing a new TPU injected ankle strap, which is the result of the know-how from the last five years. Davide Smania, product and marketing manager elaborates, “It takes the best from our existing straps–maximum power transmission thanks to its volume, maximum adaptability thanks to its geometric pattern, and total comfort due to its 3D shape, which eliminates all painful contact point while it’s almost 10% lighter than its predecessor”.

Verdad is debuting a toe buckle with an additional small lip at the bottom that prevents it from coming undone after a large impact. Burton is introducing two new Step On bindings, combining the convenience of Step On with the underfoot comfort & performance of EST. These bindings feature a new design language built around the baseplate, heelcup, & highback.

Kemper which just got started with Europe, is using the same binding design for 24/25 and carrying over the Carolina Blue and Eggplant colorways from 23/24. The bindings are ‘middle of the road’ that cover all freestyle/freeride for men and women with fun colors at an affordable price.

For the 24/25 line, Rome is pleased to expand its Pro Collection, building on the name recognition and success of key models in the line, like the Katana. The Katana Pro features boosts of Carbon fill in both the baseplate and highback for a lighter and more responsive ride while still offering the unique customization options the Katana is known for.

Finally, the new Viva from Roxy features a new cored dual band ankle strap for increased flexibility, comfort, and control.

LADIES FIRST!

Nidecker opens the ball here. With their automatic, semi-auto, and manual binding categories, it clearly tries to cater to every snowboarder. Tom Wilson-North claims, “We do it all and we have it all! Another big leap we made for 24/25 is that our whole binding line is now unisex”.

Nitro has expanded the Ivy model to include boot sizes from 21.0 to 24.5 Mondopoint and introduced the new 3D Optiframe Flex ankle strap. “These additions cater to the growing demand for advanced bindings among young women and offer the ultimate riding experience for the progressive female rider”, reinforces Tommy Delago. And for 24/25, Nitro has also collaborated with team rider Alexis Roland, who is known for her creative style both on and off the board. This collaboration–and the resulting graphics–is available on the Ivy binding.

Bent Metal Binding Works has designed a new highback for the women’s Metta with a refined love handle and medium flex. The brand has also developed a new solid highback for the Forte for a more responsive feel. Robert Longin at SP offers, “We want to focus more on girls specific products”. Word.

AT YOUR SERVICE

Brands get creative to serve and involve everyone. David Pitchi notes that “By merging Yes and Now, we are aiming to reach all our current customers combined and expand to whoever is ready to ride innovative products. By offering a complete package of bindings and boards for different riding styles and levels we believe we have something to offer for everyone who wants to have awesome days on the hill”.

Pitchi adds another layer, noting that “By merging Now and Yes, we’ve boosted our development team’s resources, allowing us to work more efficiently and offer our products at competitive prices. This is the first year we’re producing bindings under Yes, and there’s no price increase”. So a word to the wise.

Rossignol hasn’t been able to relocate some of its production due to minimum order quantities and raw materials availability across the planet. But the factories they work with are conscious of the need to be flexible, from capacity to country of origin, and lower their environmental impact. Arnaud Repa explains, “This allowed us to join our raw materials purchasing across our factories and access cheaper products. Therefore to reduce our wholesale and retail prices on the associated products, snowboard bindings and snowboards in particular”.

Karakoram is excited to have a local supply chain and one that truly supports snowboarders. “Offering bindings built with a local supply chain and built by snowboarders is something we’re really proud of. The local supply chain allows us better transparency in checking that environmental regulations are followed, as well as minimizing carbon emissions from transport”, offers Kyle Hansenkahn.

Bataleon’s simplified warranty process and the Never Miss a Day spare parts package that comes with every binding distinguishes it from the competition. Both shops and end-consumers value these minor innovations, recognizing the company’s authentic understanding of snowboarding culture.

For next season, Flux is focusing on all ranges in its collection. After all, the brand makes bindings to fit everyone.

Ruairi Collins, Jones’ European Marketing Manager emphasizes, “We want to make sure that we have a binding to match the riding style of all our customers. The Jones binding collection includes a high-performance binding option for riders of every style and skill level. And we are very excited to have dropped the price of almost all our binding models for 24/25”.

Amplid Founder Peter Bauer summarizes the design philosophy behind its 24/25 bindings, noting they’re “Simple, durable, and (super)light”. Yet still unbreakable.

Drake reminds us that one of the best ways to create sustainable goods is to ensure they are truly durable. Product and Marketing Manager Davide Smania, notes that “Having durable goods is always well appreciated”.

Similarly, Acham at Head emphasizes that “One big key trend in the snowboard market – or rather in all industries – is sustainability. We call it Rethink and we address sustainability in every decision we are making and we keep improving year by year”.

With brands firing on all cylinders, healthy inventory levels, and plenty of innovation, Winter 24/25 stands to be especially promising. But perhaps more importantly, these brands are looking beyond next winter, inspiring riders to protect our playground for future generations as well.