Stand Up Paddle 2016 Trend Report

|

| Starboard |

The summer of 2015 will go down in SUP history as the year where the sport’s popularity exploded through the following combination of elements:

1. Product availability through various networks.

2. Exceptionally warm weather in key waterfront cities across Europe.

3. Increase of SUP rental centres with licensed instructors dedicated to the sport.

The convergence of these factors has created a surge in demand and caused many boardsports companies to rethink their future product portfolio in order to get a larger piece of this rapidly growing market. Trend Report by Robert Etienne.

We can also thank the early adopters and other industry enthusiasts for setting the trend. It is due to years of diligence, perseverance and promotion from these passionate enthusiasts that all this happened. Today SUP activities are present on almost every European body of water and it has become this summer’s ‘in’ activity. It is an unprecedented phenomenon and is envied as the fastest growing water sport for the past few seasons. As in any rapidly growing sport there will be many hurdles that still need to be overcome, but because of its broad appeal, accessibility and mainstream fun factor, the SUP industry will certainly keep its freshness and remain lucrative over the years to come and beyond.

Many retailers have come to realize that this industry has a lot more to offer than they ever imagined. As we enter the 2016-buying season, both SUP specialists and mainstream buyers will need to plan carefully and buy smart for next season. Retailers will have to carefully evaluate their 2016 pre-booking, as they will not want to miss the impulse buyer, once the first rays of sunshine hit the European coastlines and waterways early in the season.

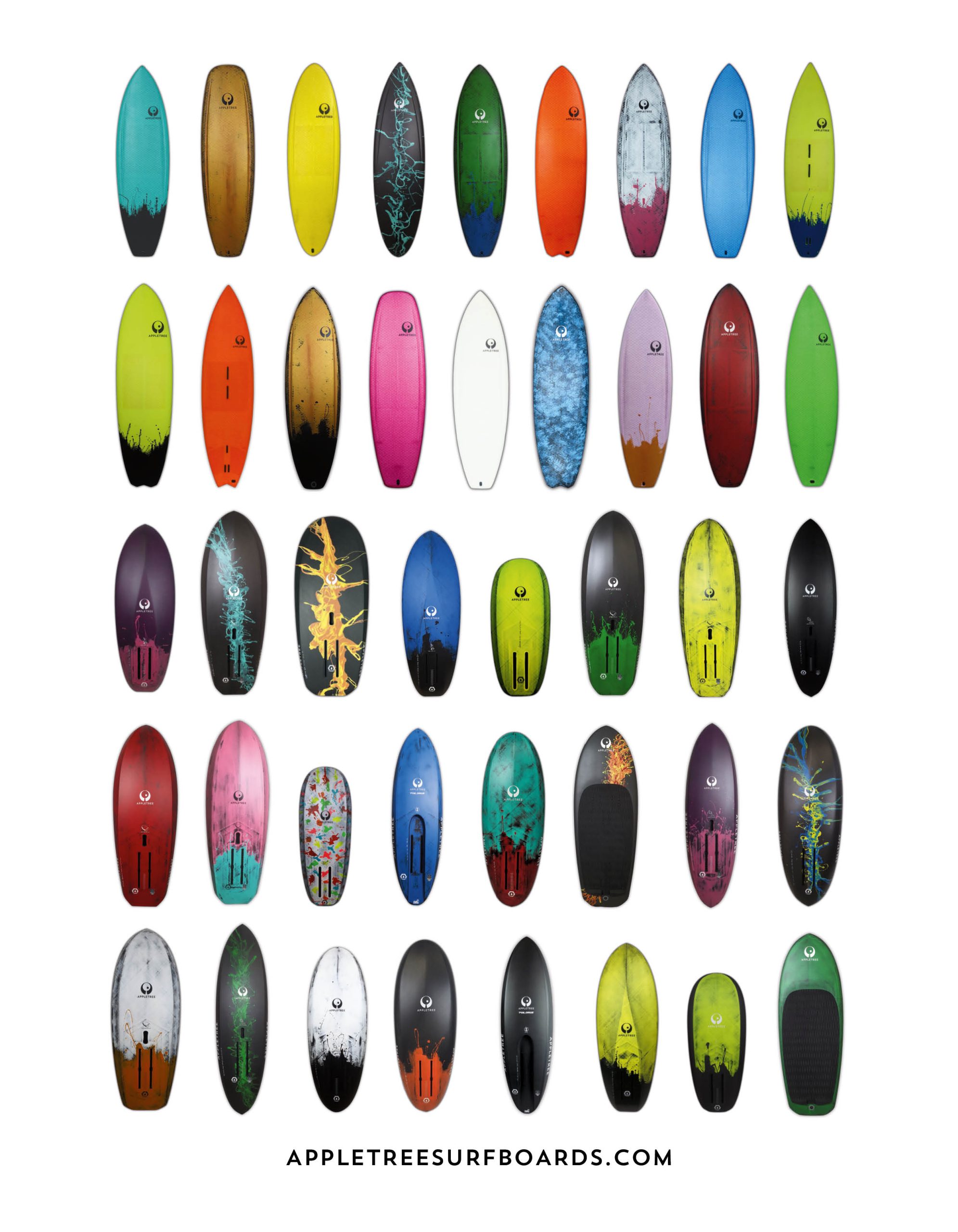

SIZES, SHAPES AND FEATURES

As the market matures, manufacturers are fine-tuning their range with a clearer understanding of what the consumer wants. The majority of entry level 2016 production will remain relatively wide (32’’/34’’ up to 36’’) with volumes in the 240-300 litres range. As the sport matures, riders begin to acquire more than one board for varying and specific uses.

SUP product managers understand the importance of focusing on ease of riding and wider all-round boards in the 11’ category. In addition, the growing interest in touring requires that displacement hull noses be accessible to all, combining stability, performance and speed. Steve West, Mistral’s Brand Manager comments: “One thing has become clear, ‘Splash and Dash’ commercial operations, remain focused on short, wide boards in the 10′ x 36″ range, while commercial schools see the value now in longer boards of 11′ The small business owner who runs a centre, will invest in top notch brands and is not affected with high price tags as he will not need long to amortize them.”

On the majority of the European waterways, there’s a “discovery” trend on the rise, in which Silvain Aurenche of Lokahi sees potential: “Touring boards are, for sure, are very important now on European waters, 12’6’’ x 30’’ are and will be very popular with a wide tail to assure comfort.”

Benoit Brecq, Hoff’s Marketing Manager recognizes the need for more volume and glide on the race front and analyses: “Due to a few changes in the SUP race regulations we have seen a big jump into 14′ race SUPs with narrower 26″ to 27″ widths as well as for downwind 14′ SUPs. All-round 10’6’’, 11’ or 10’2’’ (but wide) SUPs are still popular to match the average Joe’s needs.”

|

| Fanatic |

INFLATABLE BOARD CONSTRUCTION

In last year’s BoardSport Source SUP Trend report, inflatables were recognized as the fastest growing and largest segment of the SUP industry. One year later, apart from quality, purpose-built boards, there are now tons of low-grade inflatables, misleading consumers with low quality generic product.

Fortunately, companies such as Red Paddle, who only produce inflatables have been at the forefront of innovation as their Media Director, Luke Green points out: “Our mission has always been to produce boards that offer an authentic experience. This has meant we have been focused on using hand laminated second layers to increase stiffness and durability, which uses quite a lot of glue, material and of course is open to human error and differing quality during production. Over the last 18 months we have worked on an automated system where we are able to fuse the second layer on to the drop stitch core during the raw material phase rather than at the board production stage. This is done by machine and is therefore completely controllable and measurable. We call this MSL Fusion (Monocoque Structural Laminate). This means we now have boards with a superior cosmetic finish, that are up to 2kgs lighter and actually stiffer at a lower inflated pressure than before.”

It must be stressed that one needs to look closely at the configuration of the drop stitch construction as if not closely woven it will not support pressure’s above 17-20psi. In terms of the results obtained, Scott Warren of Starboard remarks: “The materials take another leap forward in technological understanding. Being lighter, stiffer and stronger the new inflatable boards offer a better paddling experience than ever before. The main area of development has been within the material itself, looking at how to produce lighter, stiffer and stronger materials which maintain the flexible, durable qualities required for inflatable products.”

|

| Red Paddle Co |

FUTURE INFLATABLE SALES

Leading brands are finding it difficult to continue to maintain market share as the sport matures and more brands fight to enter the inflatable market that now counts for between 80-90% of the market depending on the country. In some markets such as Germany we could hardly believe it when Markus Schörling Germany’s Red Paddle distributor told us at Paddle Expo last year that the German market was 90% inflatable.

This trend has continued to evolve as Silvain Aurenche of Lokahi highlites: “It all depends where we look at. Today 98% of SUP boards, in Germany are inflatables. But in countries like France, Spain, Portugal and also the Scandinavian countries we still sell a majority of hard boards.”

Delpero of BONZ is more nuanced: “We think that this market will be stabilized in a near future,” and Helgo Laas has a more positive note and states: “It will get close to 90% in certain countries in Europe”.

Karin Gertenbach, Head of Marketing at Fanatic International goes on to say: “The iSUP sales are still increasing, however many customers start with an iSUP, getting them over the barrier of the large size/storage/transportation of a SUP is what iSUP’s are perfect for. Casual users will keep their iSUP for a few seasons, however I have personally seen that many of the iSUP customers move onto composite boards/add a composite board to their quivers, as they get addicted to SUPing.”

For Bic it’s a different story as in their Vannes factory, they produce hardboards only. So Benoit Tréguilly, from Bic’s Marketing & Communication department sees a stabilization or slower growth, while Scott Warren of Starboard explains: “For the past few years inflatable boards have been leading the way in sales figures. For 2016 the growth we are seeing will continue to expand as the sport gains more spotlight in the world’s media”. Brunotti, the lifestyle clothing company, has lately entered into the SUP market and have ambitious plans for the future as conveyed by Casper Bleijenberg, Brunotti Sales Director: “The SUP trend is growing rapidly in a complete new target group and will keep growing for many years to come.”

It is evident that the inflatable market has completely changed the split between hardboards and inflatables. In this shift, it has brought in all types of customers as Red Paddle’s, Luke Green concludes: “The inflatable technology side of the sport has allowed the sport to really flourish and our focus on producing an authentic board with genuine performance means the inflatable side of the sport will continue to grow at a fast pace. There is now a viable product for all types of paddlers whether it is schools, families or people looking for the most practical solution. If the trend is to continue, as it has over the past five years, then we can expect to see an even greater shift towards the inflatable technologies.”

|

| Starboard |

SUP SALES IN 2015

Sales remain consistently strong as the interest in SUP continues to rise. Agencies for the most part have missed sales, because they failed to carry inventory. Brands with structured distributors are calling the shots in their respective marketplace. Luke Green at Red Paddle Co. notes: “We have continued to grow in accordance with our forecasts and expect this to continue by at least 30%. In emerging markets there is huge potential to match the growth and success already witnessed through our distribution across the globe. That is the beauty of SUP. It is the only boardsport that you can do in every country! ”

So how does this read for brands that are diversified in other water sports? Jacopo Giusti of RRD reports: “Talking about overall RRD Turnover, in one year SUP has grown from 18% to 25% of total RRD turn over, so besides windsurfing, kiteboarding, wetsuits and boardsport accessories, year after year, SUP is becoming a very important business for the brand.” So as summer comes to an end, the outlook according to Starboard’s Scott Warren is bright: “We have seen another amazing year for SUP, growth and the sport is beginning to be seen as a year round activity, which will really open things up even more.”

|

| Fanatic |

NEW TECH FOR 2016

With SUP developments progressing so fast, we are now seeing the product designers taking in a much more ‘user friendly ‘hands on’ approach in bringing to market products specifically designed with the novice end consumer in mind. This in turn, will help make their access into SUP easier than ever before. This is significantly different than in the past, where watersports such as windsurfing ultimately suffered a strong decline, mainly because of products destined for an elite user. The progression of high modulus carbon materials is helping build stiffer and lighter racing hulls. Karin Gertenbach of Fanatic notes: “For composite, we stick to our world class production facility at Cobra for 95% of our products, always choosing the most exclusive layups possible.”

In terms of technology, since the inflatable business has become such an important part of the SUP industry, brands are developing SUP specific materials such as Red Paddle’s MSL technology mentioned above. Luke Green adds: “Also, thanks to this new laminate we have been able to reduce swing weight, enabling an even more responsive feel in the handling of our boards. He concludes without hesitation: “MSL Fusion represents the single most significant development in board construction.”

CHEAPER OPTIONS

The €400 inflatable kit (board – paddle – pump) that appear to have been the summer hit had extremely low price tags (at least 50% below the average price for an all-round inflatable). These excessively low prices send a confusing message; the user feels that he’s standing on a soft mattress instead of a ‘real deal’ engineered SUP. He does get the expected experience but he is disappointed with this first purchase. If these first timers, do not understand that the reason they did not enjoy their ride, was due to poor quality and ill fitted equipment (insufficient air pressure, poor board shape and construction coupled with a short flimsy paddle). While it allowed for them to discover a new activity, there is no assurance that this customer will be not be disillusioned.

Helgo Laas at SIC analyses Far East production: “The inflatable market seems universally under pressure with price points. An increase in Asian labour costs and the US Dollar having been so volatile has added to keep costs down. Seemingly, the hardboard market has been less affected, but this depends on your manufacturing processes in particular.” The rise of the Dollar has given advantages to the few companies still producing in Europe for hardboards, since the product is sold in Euros.

|

| Red Paddle Co |

Outlook

As we’ve heard from the participating brands, the ongoing trend is to keep boards highly accessible to entry-level consumers. Consumers are paying more attention to their gear. For example, a high performance paddle with a choice of flex, is becoming a vital piece of equipment as riders progress.

On an industry note SUPIA (SUP Industry Association) in the US is growing rapidly. It endorses Surf Expo’s two annual shows in Orlando and Outdoor Retailer’s Summer Market in Salt Lake City. In Europe, Paddle expo in Germany is gaining tractions and positioning itself as the leading European SUP Tradeshow.

After more than 10 years as an industry, we can safely say that SUP is out if its infancy stage. Let’s hope lessons have been learnt from past industries that rushed into extremes with lack of foresight and little to show for it. The SUP industry has a bright and lengthy future to the extent that the players can share the common goal of ensuring that every newcomer, goes away with such a positive experience, that his only desire is to share and perpetuate the SUP STOKE!

HIGHLIGHTS

Laminated ultralight inflatable materials

Accessible entry level models

Inflatable growth exceeds 30%

European production rises

Inflatable increases to 80% of the market

|

| Fanatic |