SUP S/S 2023 Retail Buyer’s Guide

For all those who can’t make it to the Paddle Sports Show in Lyon at the end of September, find out what the key trends and models of the SUP market are before filling out your (pre-)order forms. By David Bianic.

Dealing with the aftermath of a big party is a situation that everyone wants to avoid in the boardsports market. Periods of consumer frenzy followed by a sudden stop… “Overestimated sales forecasts have caused overstock problems for the watersports market as a whole.” says Chap Zang, Senior Product Manager at Aqua Marina. To be more precise, Bruno Sroka of the Sroka brand believes that the reasons behind this situation can be traced back to 2021: “The brands, to compensate for delays in the supply chain, have over-ordered. The delay and the surplus of stock has seen the stores filled with 2021 material in the off-season.”

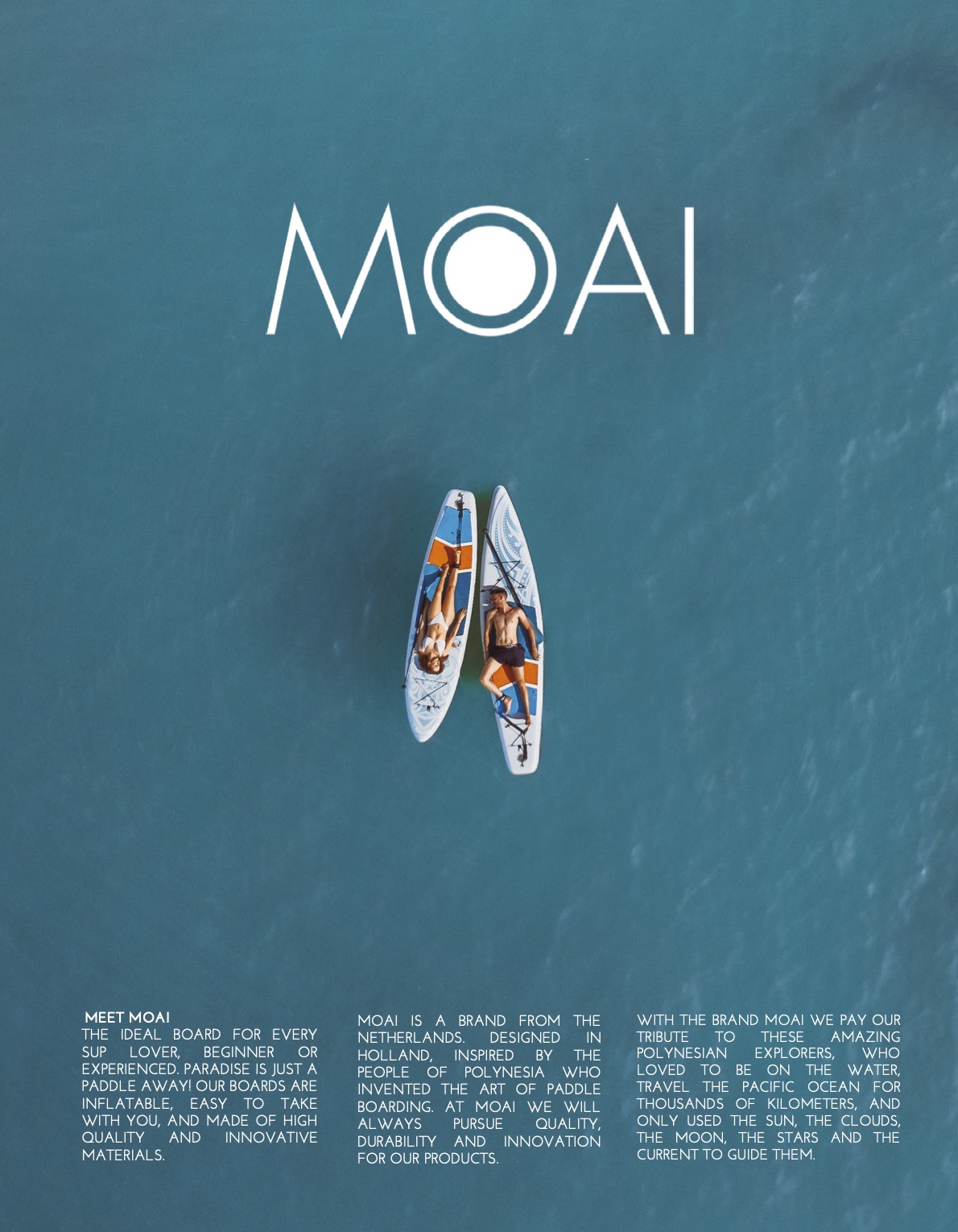

Among the consequences of this oversupply are discounts being introduced too soon: “before the snow had even melted the chains had SUP’s on sale”, laments the Corran from Soul Waterman. How are you supposed to maintain your pricing policy or even sell what you produce? This situation has mainly affected the entry-level SUPs while sales of high-end SUPs have remained similar to the pre-COVID period, according to Corran. Like many, Indiana expected double-digit growth in 2022, “but we will not achieve this” admits Niki Dietrich, Sales Manager, who is nonetheless optimistic about 2023. Whilst Pleuni Holthausen, founder of Moai Bards adds “A SUP board is for most of the recreational market still a luxury product.”

The reasons for this market slump? A post-Covid era where people are travelling abroad and spending money elsewhere rather than on sports at home, as well as the war in Ukraine which has accelerated inflation. For Mistral’s Steve West, this might suggest that SUP has reached its saturation point, but “In truth, it’s a combination of factors, including late deliveries for many brands that missed out on spring sales.” He’s not alone in his philosophical outlook, as William Doornekamp, Marketing Director for Jobe Sports, assures us that this slower pace has its benefits as well.

TRADE SHOW WHISPERS

To get a better idea of the mood amongst retailers and distributors, you have to check out the Paddle Sports Show in Lyon, which takes place at the end of September in France. This kind of b2b event was almost forgotten about during the COVID years, especially since the new communication platforms between brands and retailers have taken on a less human dimension, with sessions on Zoom and other virtual showrooms,but they are devilishly effective.

“It is quite a different experience if you can try the products yourself.” says Chap from Aqua Marina, who is looking forward to meeting business partners in the aisles of the Tony Garnier exhibition center. Indiana will be among the exhibitors as well,with a considerably larger stand than last year, although Niki Dietrich still recognises the importance and quality of digital presentations and is investing heavily in them. The same is true for Steve West at Mistral, who sees brands continuing to invest in B2C channels “to cut the fat off retail prices, increase margins or reduce the logistics of dealing with distributors or retailers.”.

At Jobe Sports, they are full of praise for the Lyon show, although the brand will not be present this year, suggesting that these meetings in general must evolve: “Where you used to go to a trade show to find brands, the internet has long replaced this” says Indiana’s Niki Dietrich. So in the future it will be more about meetings to care for their customers than to find them.

Trade shows have another, less obvious virtue…seeing what the competition is doing: “ironically, shows are ideal venues for plagiarising ideas and always interest design teams and sales personnel to relay new developments and ideas back to HQ.” confides one of our interviewees.

PRICES & AVAILABILITY SS23

Over a couple of cold pints (alcohol abuse is dangerous for your health, not SUP) on the stands of the Paddle Sports Show, brands and dealers will no doubt raise the thorny issues of price increases and guaranteed delivery times.

First up, the delays seen in 2022 forced a great number of brands to carry-over part or all of their ranges into 2023. This is the case at Starboard, says Ollie O’Reilly, Product Manager. When it comes to evolving models (technologies, decos, shapes), the brand started production well in advance compared to “normal” years. In fact, some 2023 models are already being shipped. The same goes for Shark SUPs, after making lots of updates in 2022. As the CEO Alan Xu reminds us, these carry-overs also have the benefit of not affecting the RRPs of products already in place. Butbeware, “if factories do not have your order by the latest, end of September, you will receive the product in late May or early June.” warns Steve from Mistral. But this is not the case for them after a highly-anticipated overhaul of their visual identity and business model following the arrival of new management. For their part, F2 are proud to already have their summer 2023 collection in stock, even with lower prices on some models, thanks to higher order quantities.

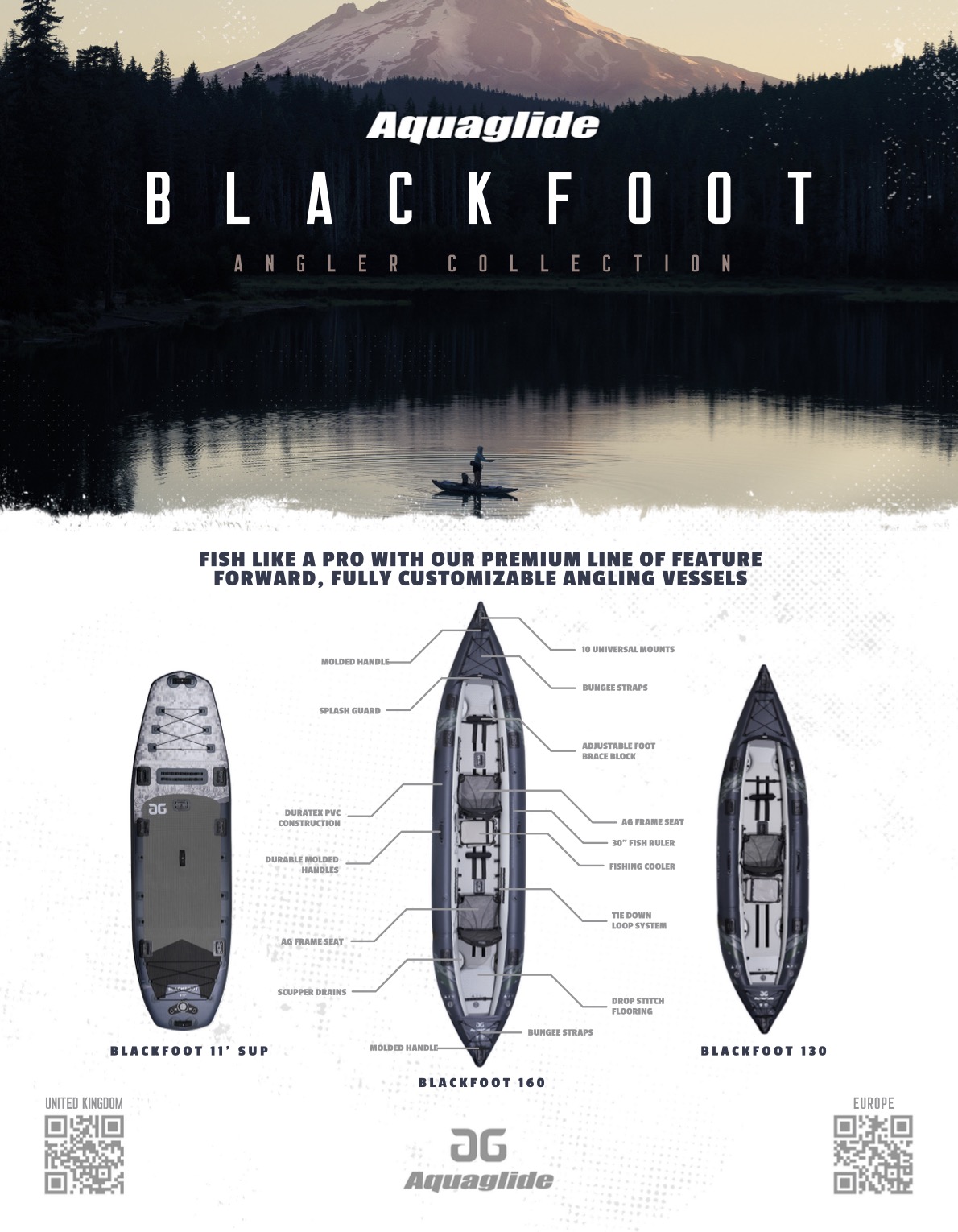

Same thing for Aquaglide which ensures they will have their EU and UK hubs loaded with 2023 product ready for the Lyon show. On another note, the brand has been able to keep the prices under control, as they have bought huge volumes of raw materials, since their main business is aquaparks. What is unknown is the future dollar/euro exchange rate. If you are looking for a lesser dependence onpricey sea transport, it is best to have your very own factory on site, as does Tahe who manufactures in Vannes, in France and so is “close to the [European] market”. Likewise, Gladiator produces everything within the package on site (excluding the Bravo pumps), which in addition “helped keep costs down”, points out Gary Willingham. Keep in mind that the English brand is the paddleboard division of BS-Marine Ltd., a company dedicated to inflatable boats.

Brands are not hesitating to cut their margins to avoid upsetting the market. At Corran, they are talking about a 600% increase in transportation costs between China and Canada compared to 2019 and a 20% increase in material costs, while public prices are only going up by 5%. “Profits in 2021 and 2022 are $0 (if you can move product at all).”

SUP TRENDS SS23: WIND IN THE WINGS

The success of SUP with the general public lies in its accessibility, embodied in the all-around models and as new riders continue to discover the paddle, this design will remain the #1 selling board in 2023. “Demand for high performance and specialised SUP surf boards has been declining,” confirms legend Michi Schweiger at Naish, “which shows the wider spread and appeal to a broader market segment.”

In fact, for a significant portion of the customer base, the stand-up paddle side is dismissed and the SUP is seen more as an inflatable kayak. Spinera have made this their speciality with their hybrid Sup-Kayak models featuring double air chambers and equipped with a cavity for the seat, a backrest and an additional fin at the front to go straight. All Ohana’s iSUPs are also equipped with kayak seat attachments and are sold with a two-piece hybrid paddle SUP/kayak. This market segment should not be overlooked by boardshops and it is precisely Bote’s target, the US based brand now aiming hard for Europe: “Angling/Fishing, this is the boom we see continuing. The outdoor mentality that COVID helped create is refining how recreational users are using SUP’s, and now they want to do more with their water time.” The same views are expressed by their fellow countryman at Aquaglide, who offer a angling specific series, Blackfoot Angler, which isdoing bigger numbers in 2022 vs 2021. Their booth in Lyon is set to focus largely on the fishing experience, riding on the path less traveled with its packrafts, those ultra-light crafts (2.8 kg for the lightest one) halfway between a kayak and a raft, “really a big topic that is set to expand” says the Aquaglide staff.

But as these neo-SUPers progress, they turn to more specific models. As a result, the touring category has grown considerably in the past three years. Even better, “we can see more beginners purchasing a touring shape board as their first board,” says Chap from Aqua Marina. It’s a short step from touring to adventure with SIC Maui’s Okeanos Expedition Air, a 14″ board that comes with a drybag-style backpack, “which allows you to plan one-way adventures or use your paddleboard as a commuting option,” suggests Brand Manager Casi Rynkowski.

Another noteworthy trend is the search for compact models, a path first explored by Red Paddle Co. back in 2018 and whose 11″ Compact MSL remains the flagship of the range, able to carry up to 110 kilos despite its mini size when folded. This phenomenon is particularly significant in the Netherlands, confirms Pleuni Holthausen, Creator of Moai Boards: “In Holland we have a lot of cities with canals. The smaller models are easier to store and to carry than the regular ones.” Also more compact, but not for the same reason, iSUPs are increasingly available in reduced thicknesses (the standard being 6”) to suit lighter riders (women, teenagers and small men). For example, Gladiator’s touring models are 4’7″, which requires the use of a high-quality dropstitch to prevent the board from bending. “The 4.7″ thickness is very important to the lighter rider as this board volume allows the board to sit within the waterline creating stability”, explains Gary Willinham. For Alan Xu of Shark SUPs, “there is often a misconception that one size fits all and this is something we are incredibly passionateabout, to re-educate the market”. Shark are therefore offering two thicknesses on their all-round and touring models (5″ and 6″) as well as a variety of widths/lengths. Moreover, lengths are getting shorter: at Vast Boardsports, the classic 12’6″ touring model is losing a foot, says Tom Lazarus.

In contrast to the scope for leisure, SUP foiling is now embodying the sport’s athletic dimension, taking the lead over race and SUP surfing. “It is becoming possible to make incredible downwind with a few strokes of the paddle.” says Bruno Sroka, who has developed new front foil wings specific to this discipline, “like the 1350 and its very high aspect ratio.” Wing foiling has also given ideas to SUP brands as more and more riders are using a wing with a simple SUP to ride upwind: “It opens up a whole new world and people who already had a SUP lying around can enjoy it in a whole new way,” says William from Jobe.

iSUP SS23: TECHNOLOGIES & KEY MODELS

In line with the large number of carry-over models, 2023 will not be a crazy year in terms of innovations and that may even be a good thing to stabilise a somewhat shaken market. Beyond these considerations, Steve West of Mistral believes that continuing to constantly develop, with the consequent costs, would be taking it too far for users who are essentially focused on leisure.

But there are still some interesting technologies in the inflatable category. Ready? At the American river and whitewater specialist, Hala Gear, there is a mysterious new stiffening material: “we called it “carbon” but it’s stiffer, lighter, and doesn’t have carbon”, teases Peter Hall, Founder of the brand. This innovation will be found on the Carbon Hala Nass, the stiffest of the touring boards, he assures. Carbon once again from Jobe on their top-of-the-range, Elite Series. In addition to “rail tapes”,sandwich reinforcements on the glued seams (top-bottom),a carbon “sidewall” makes its appearance.

Although Starboard are updating their entire iSUP collection in 2023, we haven’t had the chance to mention this innovation from 2022: the ICON (iGO and Touring models): a new dropstitch that allows them to make a concave cavity on the deck as well as on the hull. On the top it provides more control by being lower and with more support on the edges, while on the bottom it gives a catamaran hull shape for more stability.

The use of a dual chamber construction is nowadays more important for the shape it provides rather than for its safety benefits (in case of puncture). Here we think about the 11’6” Hyper from Aqua Marina, a fully equipped touring model.

In general, the use of Fusion dropstitch (woven) is expanding on performance models like at STX with their FXL technology (Fusion Xtra Light). With this mesh, the boards are lighter and stiffer because the diagonal weave provides more tension. That’s how STX can guarantee that the boards can be inflated well beyond the recommended pressure of 15 bars, up to 20 bars and more. The expansion of the woven dropstitch now means it can be offered at really affordable prices like the SUP Light 9.10 ULT from Spinera (single layer), on offer at just over 400 Euros.

As mentioned above, the combination of a wing and an SUP (without foil) is no longer just anecdotal. The proof comes from Mistral with their Sunburst. This 10’5” x 32” x 4.75” is the inflatable version of the composite Sunburst, equipped with small twin lateral fins designed for wing-surfing. Similarly, wind-SUP is breathing new life into windsurfing and F2 are offering a large number of SUPs with a mast foot: Allround Air Windsurf, Cruise Team Windsurf HFT, Glide Cross, Glide Move, Glide Surf, Glide Windsurf, Glide Wing, Glide Woman, Peak Windsurf, Ride Windsurf, Team Windsurf, Travel Windsurf. Sorry! This cross practice is also the idea behind the iCrossovermodels from STX, SUPs made for paddling, windSUP and wingsurfing.

We can finish up with a growing trend, namely more and more elaborate decos and graphics, particularly using new technologies. In this way, Anomy are using digital printing to offer complete illustrations, signed by famous artists. The SUPs also carry the names of these illustrators. The results are striking and hanging these iSUPs on your living room wall isn’t hard to imagine. Even better, the Pongo 3D collection from JBay.Zone in 2023 will feature three-dimensional illustrations, to be admired with 3D glasses! And even without glasses, their “classic” Artist Series collection offers some highly original illustrations. You won’t go unnoticed on the beach! F2 also deserve a mention in this regard with a women’s collection that’s really wide and with artwork that works really well.

SS23 RIGID SUP: AN ENDANGERED SPECIES

It’s simple: count the number of composite boards in the water and you’ll soon be able to estimate the market share of the rigid SUP. A semi-pro racer perhaps, an old SUP surf rider… And while there are almost no rigids in shops, it is very often a question (of lack) of space, assures Steve at Mistral. Some are moving on , as is the case of Jobe who are doing away with their rigid range to concentrate on their inflatable offer.

Of course, some brands are doing well thanks to the good results from their boards in races for example. Indiana are launching a new “racing machine”, the 14′ DHC Race Dugout Hollow Carbon Wood in 21.5″ wide, “which has already won a number of medals.”, Niki Dietrich says with satisfaction. Starboard are also clearly continuing to improve their Race range in 2023, mainly with new advances in Wood Carbon technology, “which features more than double the amount of carbon.”

High-end sport touring models also continue to occupy an interesting niche in rigid SUP. The perfect example is a 14′ Streamliner with wood veneer from Corran, inspired by 1950s outboards, “using honeycomb carbon fibre and a combination of ebony and Acid Branch.” An absolute beauty. The boating influence is also quite apparent at Bote through their Rackham models in Gatorshell construction with a cypress-like veneer. This “fishing vessel” is loaded with option features : Sandspear (a pole/anchor), Power Pole Micro (electronic actuated anchor), Rac(handrail for standing up assistance while fishing), Magnepod (magnet dock for a water bottle), cooler tie-down points, paddle sheath on the nose of the board… The list goes on and on! New for 2023, the launch of the Apex Pedal Drive, a compact pedal-powered system, already a winner in its category at the iCast sportfishing trade show in Orlando this year.

More understated but just as fast, the Naish Touring 12′ returns for 2023, a board “born from the DNA of our Maliko raceboard rockerlines,” reveals Product Manager Michi Schweiger. Its channel on the hull offers great directional control (less row), while the slightly recessed deck improves stability.

As per SUP surfing, the days of the low volume ankle sinker short-SUPs are over. The boards have returned to their first love of the early stand-up paddle surfing, displaying nice longboard outlines, ideal for cruising and (small) surf. It is precisely the program of Tahe’s Breeze Performer (10’6’’ & 11’6’’): “We’ve adapted our classic longboard shapes to give you great performance in the surf, but with a moderate rocker profile to provide more versatility and improved glide on flat water”, says brand manager Jacques Freydrich.

The salvation of the rigid SUP will not come from the foil, it’s still too elitist for the majority of participants but it is a niche that should be occupied by specialised retailers. SIC Maui are pushing hard in this direction with exciting new additions to the Raptor line in 2023. The Raptor Pro 4’11” is aimed at the speed and freeride enthusiast while the Raptor 5’8″ and 5’11” shapes have been redesigned, with the trough removed from the hull and the chisel removed from the tail, to “providing better glide and easier release from the water at lift-off,” says Brand Manager Casi Rynkowski.

CONCLUSION

After two years of full power ordering, retailers are being much more cautious about their spring 2023 purchases. More than ever, they need to get back to basics, as Red Paddle Co.’s John Hibbard aptly sums up, “You can’t win if you are offering the same as everyone else and you almost certainly can’t win any price battles.” He encourages them to think in terms of quality and especially value for money. It’s the same advice from Indiana; to focus on fewer brands but ones that have heritage and technology to share, that offer good service and are located in the mid/high end segment: “Cheap SUPs are only something for discounter chains.” So cultivate your difference and the crop should grow by itself.